Summer crops. Logistics patterns in the Gran Rosario.

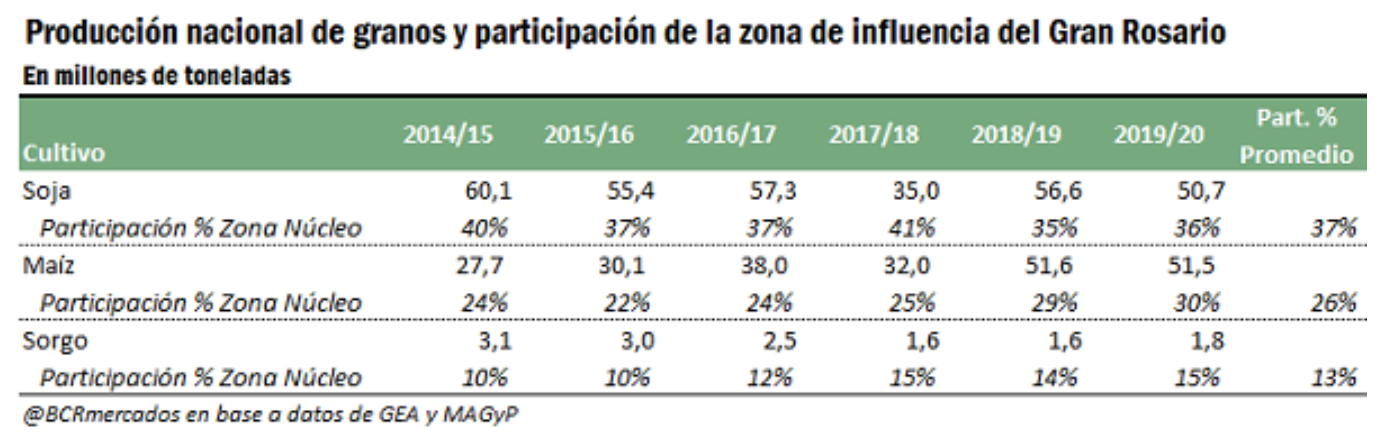

The extensive summer crops are planted every year in Argentina between the months of September and December, being harvested in a wide period that goes from February to July. In the core area of the country, which includes north of Buenos Aires, south of Santa Fe and southeast of Córdoba, the most important summer crops in productive terms are SB, maize, and sorghum. During the last 5 completed campaigns to date, in the 10.3 M ha that make up the core zone, an average of 37% of the national SB crop, 26% of maize and 13% of the sorghum.

Due to the fact that all these products intensively grown in the immediate area of influence of Greater Rosario are largely destined for external markets, the proximity from the origin to the ports offers better margins to the producer due to incurring in lower transport costs, one of the variables with the highest weight in the profitability of the activity.

SB: distribution of Affidavits, shipments, and entry of trucks to ports

Of the three summer crops analyzed, SB production in the core area is the one with the greatest relative weight at the national level. The SB harvested in Argentina is mainly used to produce oil, meal and Biodiesel in the crushing plants of the region. On average, only 14% of the harvest is exported without industrial transformation, such as Beans.

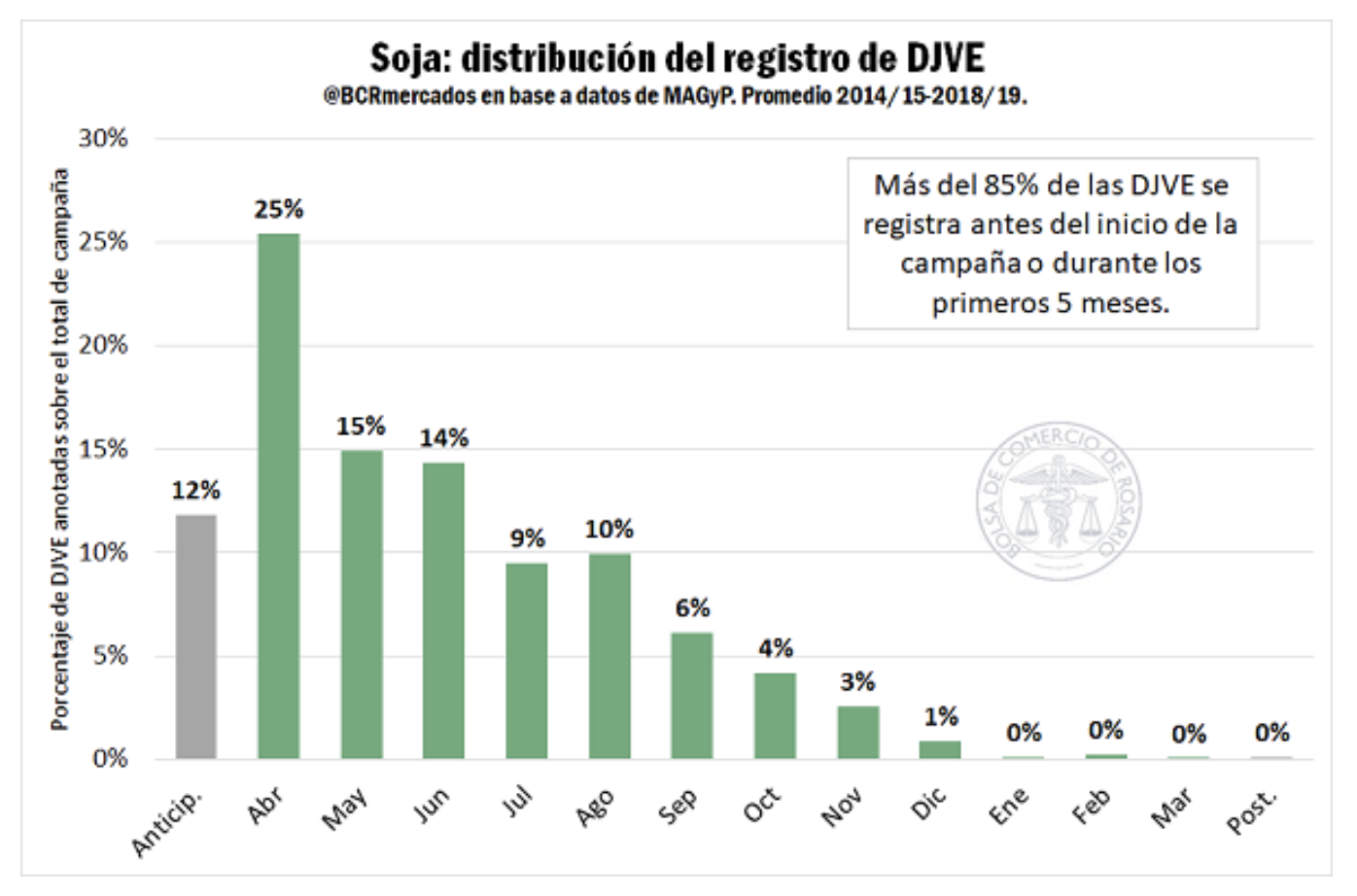

By analyzing the historical record of Affidavits of Foreign Sales (DJVE) submitted by SB exporters, it is possible to identify patterns of activity throughout the SB campaign. To do this, the DJVEs registered daily are grouped into monthly totals, also identifying the returns entered before the formal start of the business year as “Advance” and those registered once the cycle is closed as “Later”.

Thus, the average distribution throughout the last 5 complete seasons (2014 / 15-2018 / 19) shows a marked peak in the month of April, coinciding with the advance of the crop, where a quarter of the Sworn Declarations of Sales abroad of each campaign. Furthermore, in recent years more than 85% of the DJVEs are registered before the start of the business year (anticipated) or during the first 5 months of the cycle (April-August). In the second half of the campaign, the record fell sharply, with almost zero activity in this regard in the last three months.

The ongoing 2019/20 campaign showed a strong advance in the DJVE record never seen before. In a cycle where Argentina is estimated to export 7 Mt of SB, the Affidavits of Foreign Sales prior to the formal start of the campaign already totaled 5.5 Mt. That is, about 80% of the external sales estimated for 2019/20 had been registered before April 2020. This dynamic contrasts sharply with what happened in previous campaigns when only 12% of DJVE anticipated April and responds to the political and economic uncertainty present in the market since the middle of the year past.

In contrast to what happened last year, which at the end of October had already registered DJVE for 5.5 Mt of new-crop SB, currently there are still no records of 2020/21 SB sold abroad.

Based on own estimates of monthly shipments based on statistics from the Ministry of Agriculture, Livestock and Fisheries (MAGyP), patterns of external SB shipments can be identified throughout the calendar year.

Although the average share for March, a representative month of the oilseed harvest in Argentina is high, the seasonal component of beans shipments has decreased in recent years. During the last 5 full calendar years (2015-2019), in the period from March to August, 63% of what was exported in the year was shipped, on average. In contrast, in the previous five years, the same period concentrated on avarage 77% of total shipments.

In the last 5 years, SB cargoes shipped from the ports of Gran Rosario represented, on average, 37% of the annual shipments from all ports in the country. In the monthly detail, it is observed that the participation of the ports of the area in the total ranges between 24 and 42% throughout the year. The low relative participation of the Rosario Norte and Rosario Sur terminals in total bean shipments responds to the distinctive industrial profile of the area, whose main export products of the soy chain are SBM, SBHP and SBO.

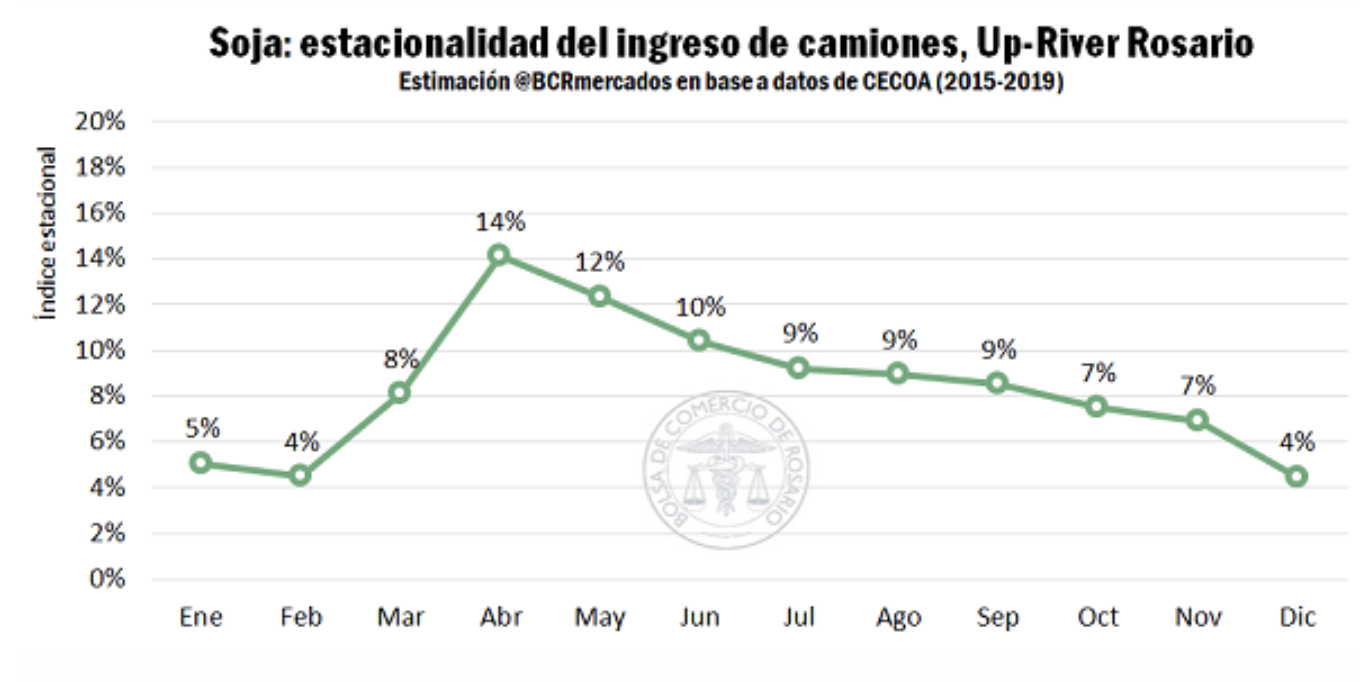

In the domestic sphere, trucks largely ensure the supply of the country’s export ports. Analyzing the CECOA statistics that register the entry of trucks until 7:00 a.m. Every day, for plants and ports of Up-River, it is possible to estimate a pattern of entry of trucks to this important export complex on the Paraná River.

In the case of SB, the average distribution over the last 5 full years (2015-2019) evidences a concentration around the Crop period, naturally. In the 4-month period between April and July, 46% of the SB trucks that arrive during the year enter the Rosario Norte and Rosario Sur terminals. However, the concentration exhibited in the average of the last 5 years is less than that registered in the previous five years of 53%.

Source: Bolsa de comercio de Rosario.

WBL Shipping Agency

For more news follow us on LinkedIn