Auspicious first half of October.

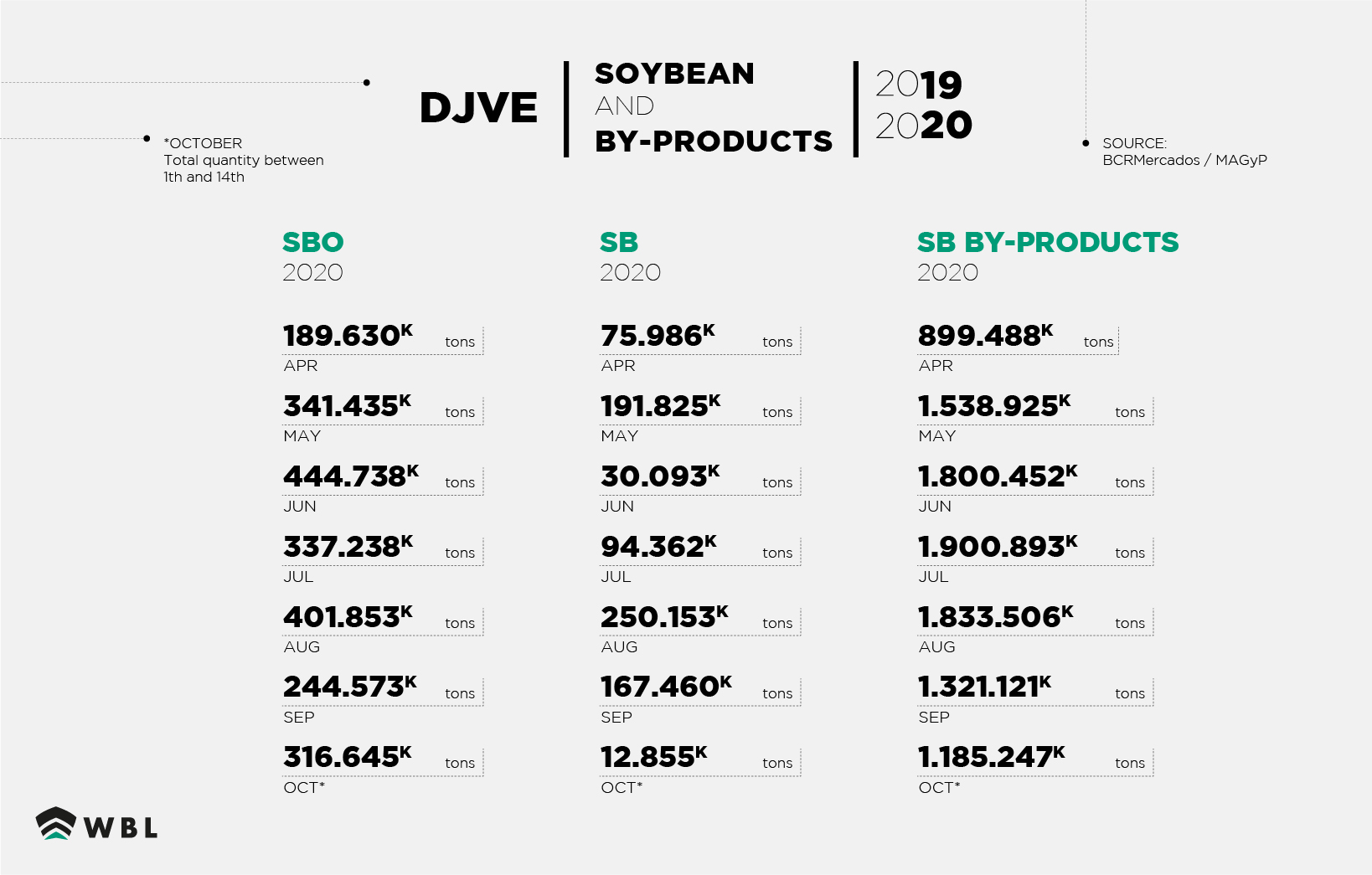

In the first days of the month, important liquidation of products from the SB complex were generated. SBO stands out, whose record of the first 14 days exceeds the amount settled in the entire month of September.

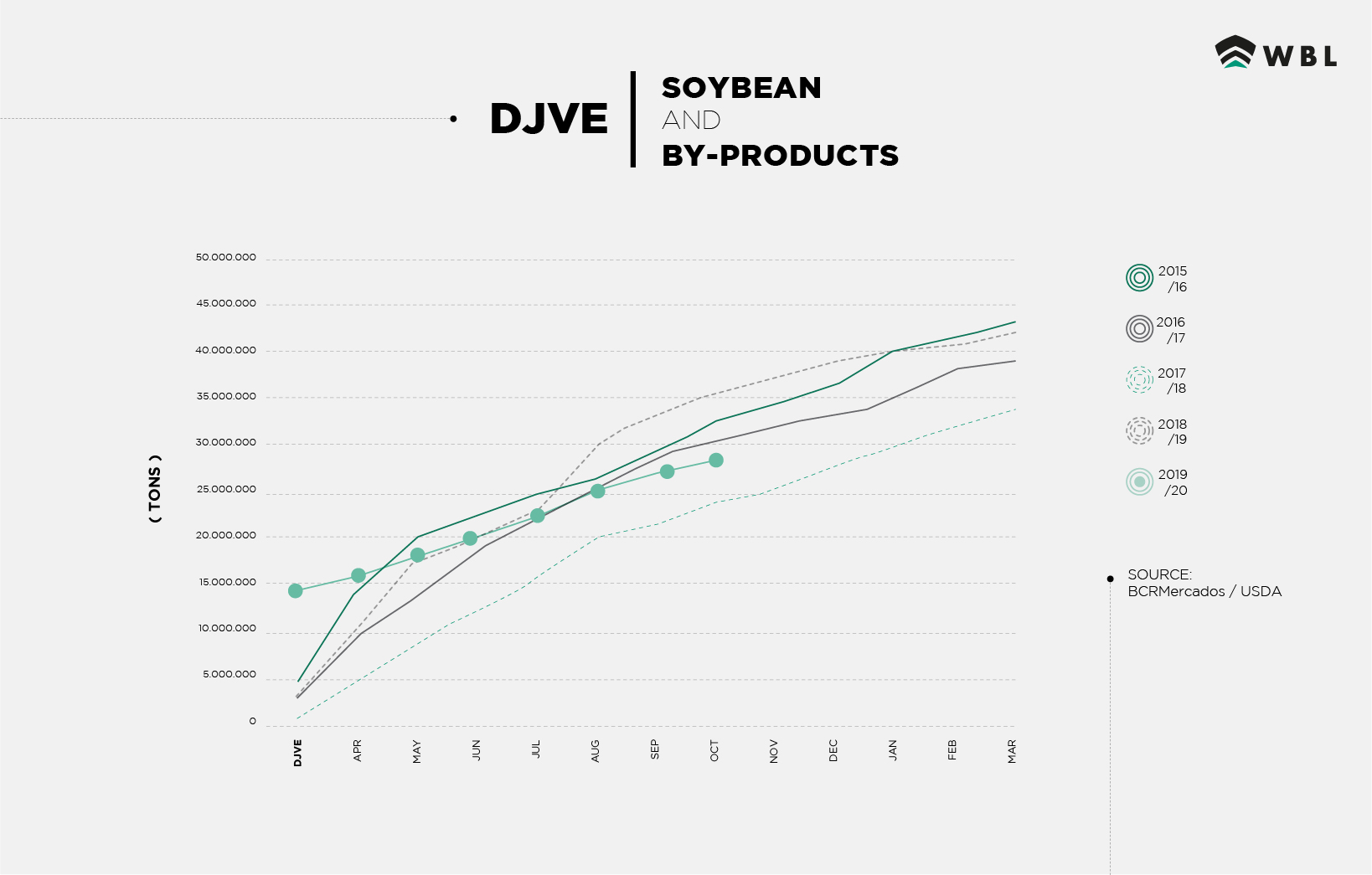

On October 1, Argentina’s Minister of Economy made the announcement of reductions in Export Duties (DEX) as an incentive to liquidate agro-industrial exports. After registering anticipated sales abroad for a volume higher than the average of recent past years (the DJVE of the soy complex -oil, beans, and by-products- for the 2019/20 campaign five times in March 2020 the average of the last 4 campaigns, according to data from the Ministry of Agriculture, Livestock and Fisheries – MAGyP), in recent months this was offset by a relatively more flat business rate, as can be seen in the first graph.

However, in recent days large volumes of DJVE have been generated from the soybean complex. The liquidation of soybean oil stands out, where the tonnage increased to the point that in less than 15 days it exceeded what was registered in the entire month of September. Regarding general commercialization, MAGyP reported that 33.18 Mt of the 19/20 harvest have been committed, both from industry purchases and exports, equivalent to 65.5% of what is produced.

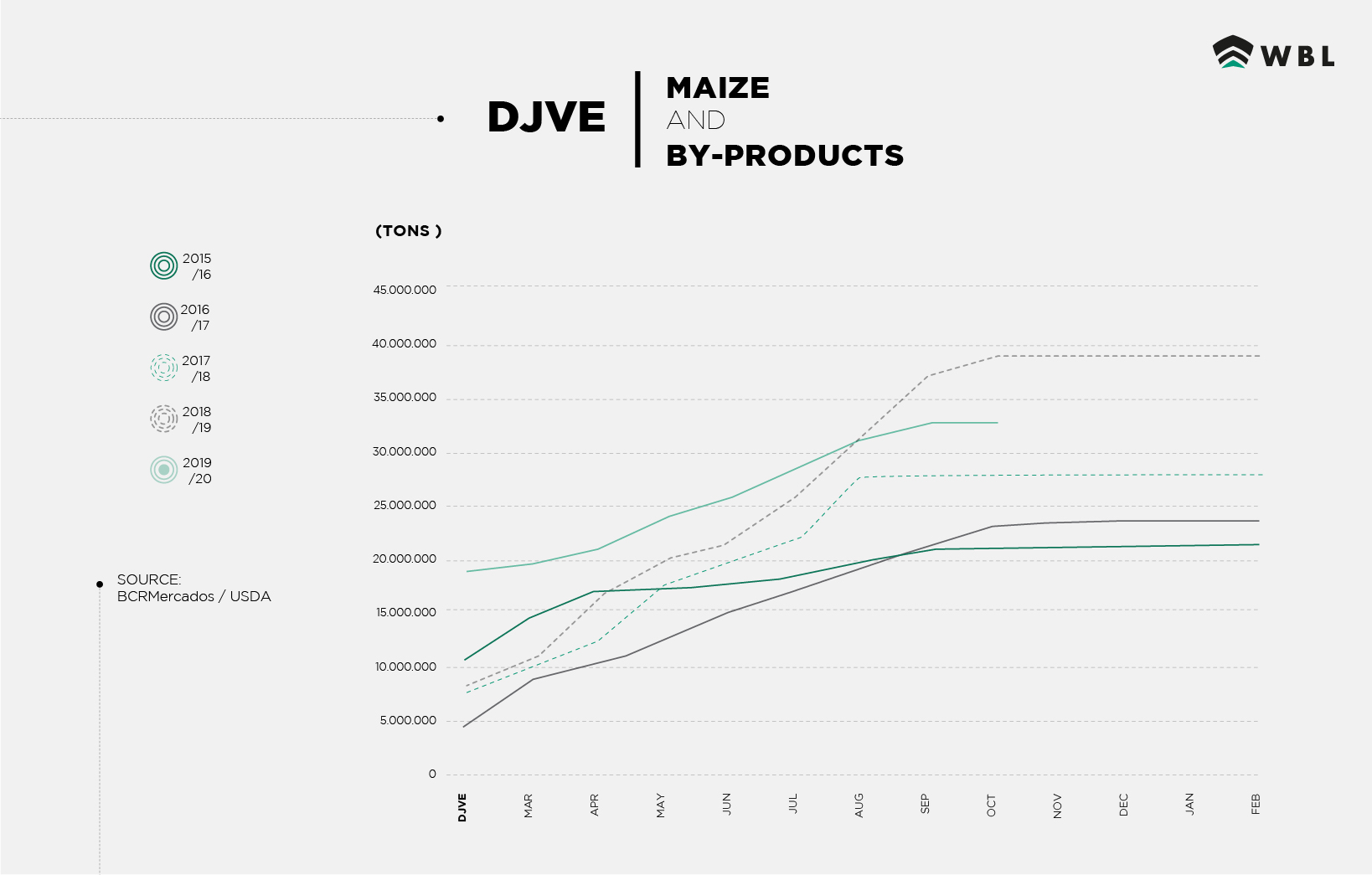

In the maize market, the 2019/20 campaign presents a similar dynamic to that of SB but reaches an important milestone, achieving the second highest volume of sales abroad in Argentine commercial history. This has provided the cereal with a competitive and dynamic market for much of the current business year. This is reflected in the domestic market, where every day there is a wide range of buying tips that reach up to next year’s business, while in the soya segment the open tips for different months of unloading have been more limited.

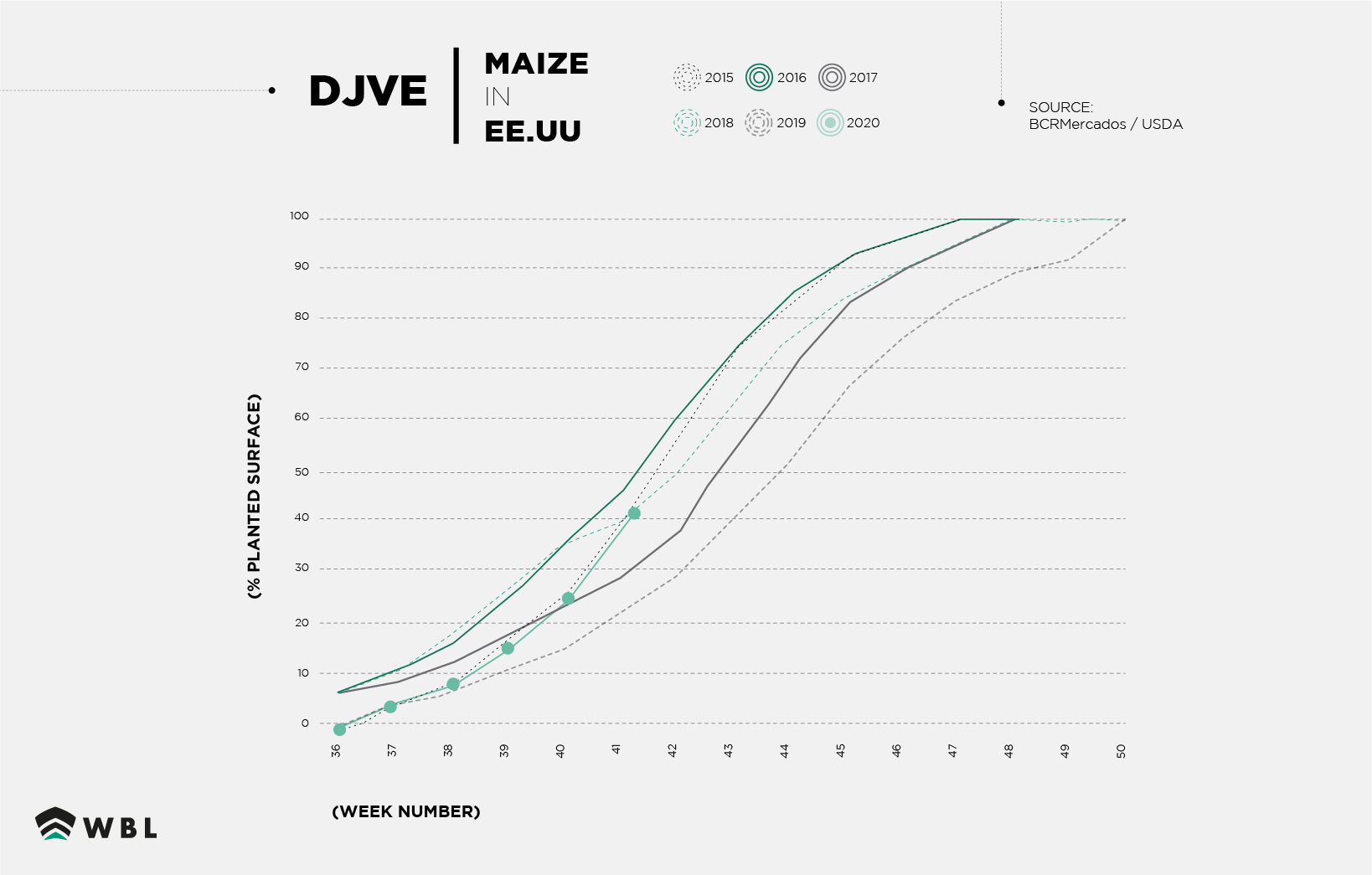

On the other hand, the tendency to specify a greater volume of sales abroad prior to the start of the harvest of yellow beans is consolidated. As of October 14, the DJVE record for the 2020/21 harvest adds 6.25 Mt of the maize complex (grain and oil). Meanwhile, the GEA (Rosario´s grain exchange) maintained the planting projection of the new season at 7 million hectares, given that even when there is a lack of water in much of the central region of the country, the intention of the producer to make the cereal remains firm. A greater shift to late plantings is expected, as a consequence of the delay generated by the water deficit on planting plans. In principle, Argentina’s 2020/21 maize production is estimated at 48 million tons, although summer will bring the decisive months to refine this number.